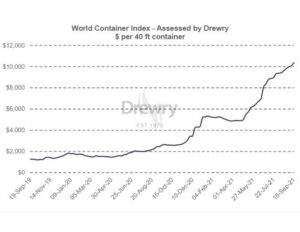

The trend in ocean freight rates has had – persistently – only one direction for the past fourteen months or so and that has been *up*. This chart from Drewry tells the tale:

Seemingly with no end in sight and shortly before the FMC announced their Shipper’s Advisory Committee and last week’s move by the ports of Los Angeles and Long Beach, we saw the following from French-owned CMA-CGM:

______

CMA CGM makes the decision to stop all spot rate increases

- This measure is effective immediately from September 9, 2021 and until February 1, 2022.

- The Group is prioritizing its long-term relationship with customers in the face of an unprecedented situation in the shipping industry.

__________

They then proceed to go through a litany of things they have done to improve things for their customers, including the nearly 800,000 TEU of tonnage brought online during that time period.

While that’s great and swell, the devil is in the details, or the fine print. While they’ve ceased spot rate increases, they and other carriers are plunging ahead with increased Peak Season Surcharges.

In previous years, these surcharges have been in the hundreds of dollars per TEU. Today, these announcements are in the thousands of dollars.

CMA-CGM aren’t the only carrier trying to take the moral high ground. Hapag Lloyd is doing the same.

The only thing is – what difference does it make when the amount of capacity taken out by ships waiting to dock and unload at ports all around the world – drives up the rates for slots and equipment that is somewhere ready to load and sail?

The market topped out last week with news that a 4,250/TEU vessel built in 2009 was chartered for $200,000/day beginning later in October. This is less than 20% of the capacity of the largest ships on the oceans today.

The fact of the matter is, the conditions in markets haven’t changed an iota. Increasing COVID closures in southeast Asia continue to impact a wide range of industries and a theoretical limit on what can legitimately be transloaded and moved by intermodal rail or truck is being reached.

Sobel continues to underscore to our clients the twin pillars of communication and prioritization. We are able to best represent our customers through this mess if we know what is urgent and we know with enough notice to secure a booking, equipment and can advise the prevailing rate.